Financial stability is based on a steady income, which allows you to maintain your lifestyle and fulfil your necessities, wants, and long-term goals. However, a potential physical or mental disability can impact your income, putting you and your family members at risk financially. This situation can lead to depleting your emergency savings, losing investment opportunities, and reducing retirement readiness.

Therefore, it is vital to have disability insurance coverage so that the impact of negative impacts can be reduced. This insurance also helps you fulfil your lifestyle requirements and achieve your future goals through savings.

In this guide, we will explore disability insurance, its features, types, coverage benefits, and cost.

Understanding Disability Insurance

Disability insurance is a type of insurance that provides income to policyholders if any mental or physical disability has prevented them from working and earning income for their households. Some insurance policies cover almost 60% to 80% of your income, while other policies cover the full amount of lost income in case of disability.

This type of insurance helps you fulfil your essential requirements and needs, ensuring you remain financially stable throughout this tough time. It eliminates the need to use your savings and helps you stay on track for achieving your long-term goals.

Features of a Disability Insurance Policy

- Benefit: It is the amount you receive every month during the period of your disability.

- Benefit Period: It is the maximum duration during which you get the benefits.

- Premium: It is the amount you or your employer has to pay for getting coverage benefits.

- Waiting Period/Elimination Period: This is the period from the time you become disabled until you start receiving benefits.

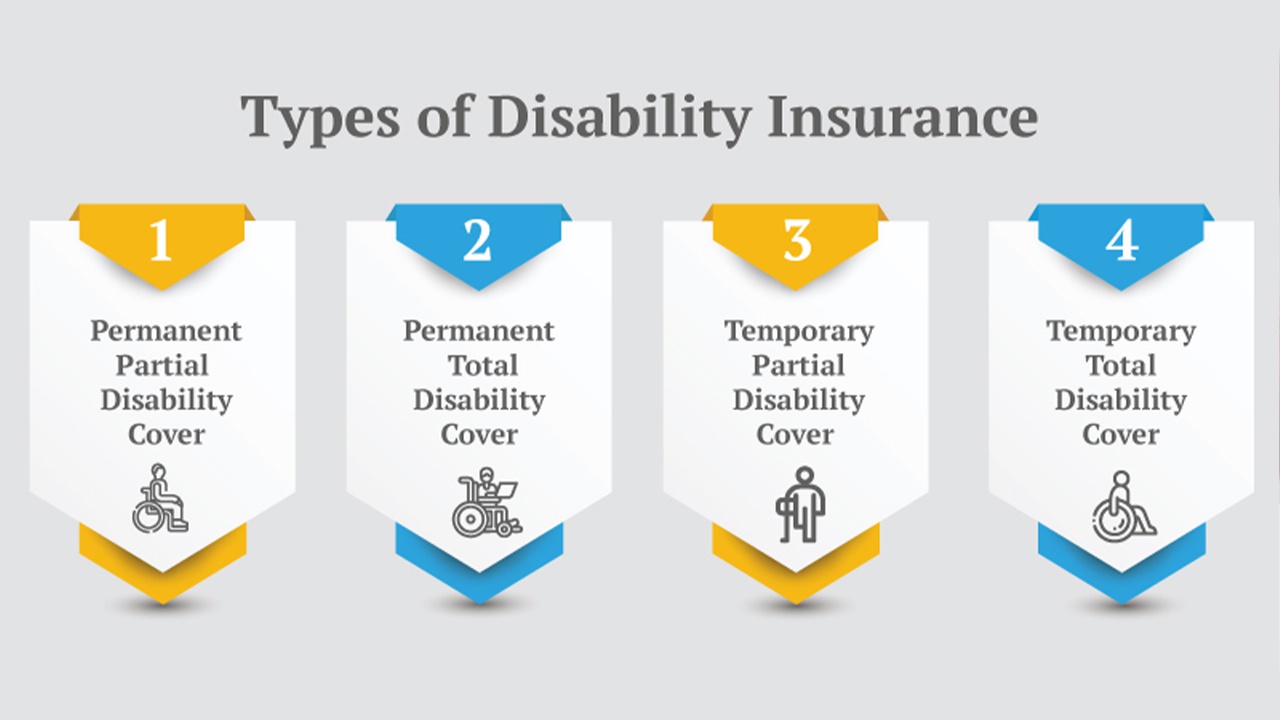

Types of Disability Insurance

There are two types of disability insurance based on the duration for which you will receive benefits when you are not able to do work:

STD (Short-Term Disability) Insurance

A short-term disability insurance policy provides you coverage for a short period with a maximum benefit period of up to 2 years. This policy begins paying the disabled policyholders within a couple of weeks after they get a qualifying injury or illness.

LTD (Long Term Disability) Income

A long-term disability insurance policy offers benefit coverage for a time span that ranges from many years to your whole life. Under this insurance, the policyholders have to wait almost 90 days before starting to receive the benefits.

Coverage Benefits for Disability Insurance

The following are some of the coverage options which you can consider as disability insurance:

Catastrophic Disability Rider

This coverage option provides you additional benefits if you have a severe disability, including the loss of senses or multiple limbs.

COLA (Cost of Living Adjustment)

This insurance coverage option increases your benefits over time as the cost of living increases as per the CPI (Consumer Price Index). However, you need to pay a higher total premium in exchange for this add-on.

Future Increase Option

This coverage option allows you to enhance your benefits in future without undergoing extra medical underwriting, subject to specific conditions.

Lump-Sum Disability Benefit

Under this benefit, you get 35% of all the total and partial disability benefits at the age of 60 which are paid to compensate for the lost savings during the period of disability at any time in your professional career.

Rider

If certain criteria are not met, some insurance policies can limit the coverage for disability resulting from mental or nervous disorders.

Non-Cancellable Policy

This type of policy is referred to as non-cancellable, as the provider cannot cancel it if you begin to pay a premium on your short—or long-term disability insurance policy. You can renew your policy every year without increasing premiums or decreasing benefits.

Own Occupation

You can avail of these benefits if you are not able to do the duties of your own occupation. This is highly suggested for professionals who work in high-paying specialized fields.

Residual of Partial Disability Rider

It is suitable to get in case of your partial disability, according to which you can work part-time at your job and continue receiving a certain part of your salary with all benefits.

Retirement Protection

It is a coverage benefit that protects retirement savings by the replacement of contributions you would have made to your specified distribution plan while being totally disabled.

Return of Premium

According to the return of premium, the company is required to refund a certain portion of your premium if no claims are made over a certain period, as specified in the policy terms.

Waiver of Premium Provision

This policy clause removes any payment responsibility towards the premium if you are disabled for more than 90 days.

Cost of Disability Insurance

This insurance is intended to replace your costs, income, or premiums during a period of disability and has a starting range of 1%- 3% of your annual income. The total cost varies based on the policy type and your unique situation. Various factors, such as your age, income level, occupation demands, and smoking status, also determine the monthly premium payment.

If you earn a higher income, you have to pay more premiums to safeguard the earned amount. The same is true for risky careers, in which the chances of getting disabled are higher. Moreover, you have to pay more premiums if you want to get any extra coverage. On the other hand, long-term insurance policies with extended elimination periods can be availed at lesser costs.

Final Words

You should consult a professional insurance advisor or an independent agent who can give you expert guidance regarding the most suitable type of policy. The specialist will assess your financial picture by determining emergency savings and employee benefits related to long-term goals and retirement plans. Based on these factors, you will learn about different options and select one that suits your and your family’s needs.