Travel Insurance

Protect your lifetime trip memories, get your journey insured.

Compare and buy globally accepted wide coverage plans

Compare and buy globally accepted wide coverage plans

| Additional Covers | |

|---|---|

| Terrorism Extension | |

| Adventure sports |

| Policy Features | |

|---|---|

| Emergency Medical Expenses | |

| Emergency Dental Care | |

| Repatriation of mortal remains | |

| Premature return (death of family member) | |

| Personal Liability | |

| Personal Accident | |

| Trip Cancellation | |

| Delayed departure | |

| Delayed baggage | |

| Personal baggage and personal money | |

| Loss of passport | |

| Terrorism Extension | |

| Adventure sports | |

| Country of Residence |

|

This plan is designed to meet requirement of travel insurance when applying for a Visa of Schengen countries. This plan covers a minimum of EUR 30,000 medical expense as required by Schengen countries.

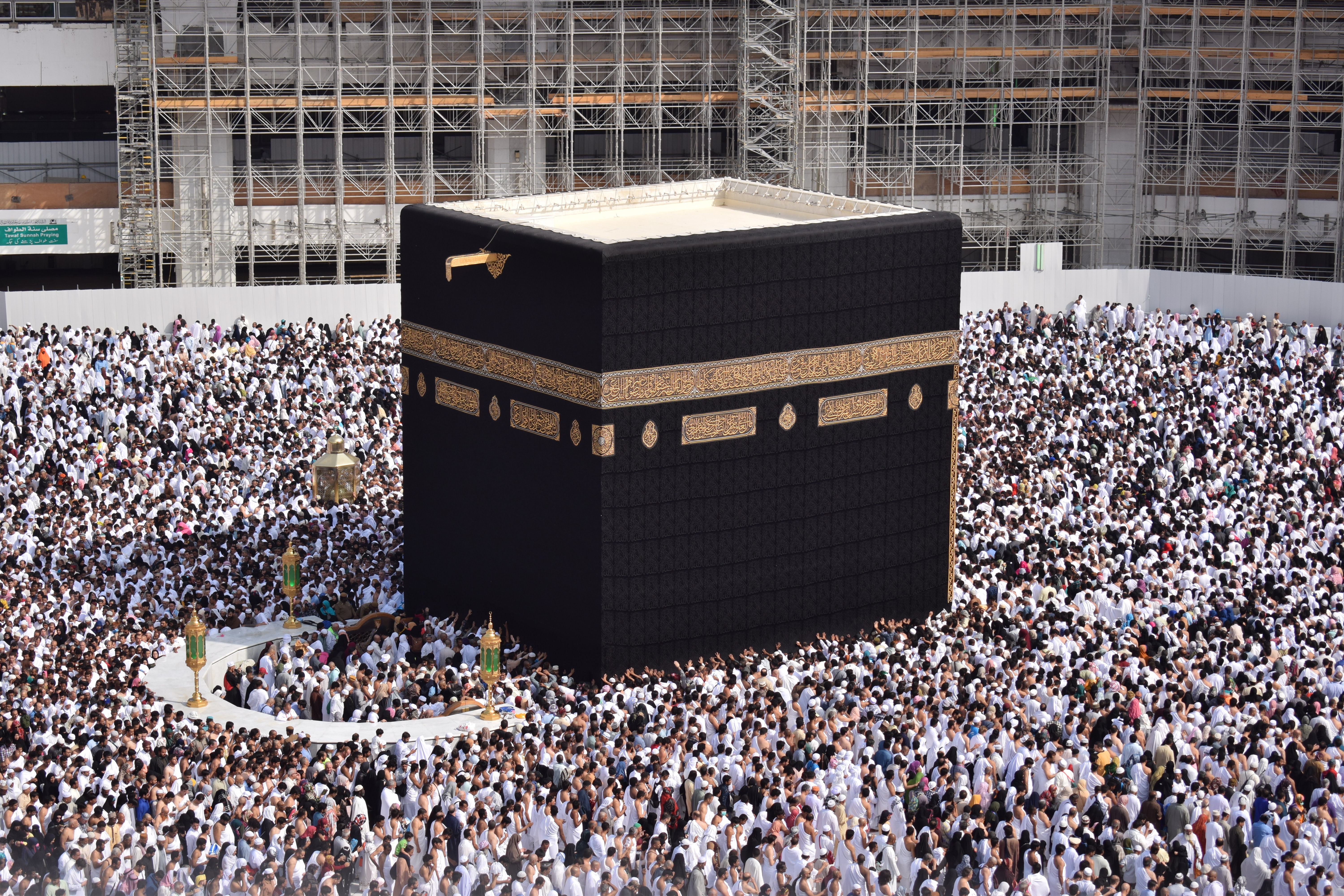

Relief yourself from risk of uncertain events by getting your Hajj, Umrah or Ziarat to Holy sites insured. This product is specially designed for the pilgrims to perform their Hajj & Umrah with a peace of mind and travel back to their loved ones safely.

Traveling for higher education, trainings or on student exchange program, Student plan is designed for students to cover health expenses, emergency return to home, and other benefits during their stay abroad for study.

Exploring Pakistan with family, travelling domestically on business trip or for a family commitment, this is the most economical plan that covers you from any medical emergencies, flight delays, loss of baggage or CNIC and a lot more.

Looking for minimum coverage at low cost? Don’t worry, rest of the world plan gives you all features of best travel coverage with low limits at low premium. This is best for those who do not require travel insurance to meet visa requirements.

Travel anywhere across the globe with high limits of coverage and benefits. This plan is most suitable to travelers with high volume of annual trips. The coverage limit for most insurers for this plan starts at USD 50,000.

Some Health Insurance and travel insurance covers overlap.

Similar to health insurance, medical expenses are covered in travel insurance policies. Although travel policy may not respond unless the medical expense incurred was due to an emergency or a covered event.

All policies cover 24/7 Worldwide Assistance service

Travel policies are designed to protect you from bad memories and unforeseen financial loss during unexpected events. Hence all insurers have made arrangement globally with assistance service companies to support you in case unfortunate event occur.

Travel is an umbrella coverage for trips

Travel insurance is a package policy with various covers such as medical expenses, lost baggage, delayed departure, loss of passport, repatriation and the like many more covers.

Visa requirements include Travel Insurance for some countries

Some countries have a minimum requirement of travel insurance before applying for visas such as for Schengen Countries, Turkey, Canada, UAE, Thailand, etc.

Some countries have made Travel Insurance as mandatory pre-requisite for Visa Application or for getting immigration stamped for visitors. In the absence of insurance the country may prohibited you from entering or getting Visa stamped. Your travel agent may be able to guide you if your destination country has made travel insurance a pre-requisite for visitors.

Avoid Travel MishapTravel mishaps such as loss of passport, baggage, flight delays, missed flight, emergency evacuation may incur during your trip. Travel insurance plans are designed to provide financial support if such and various other incidents occur.

Medical EmergencyHealthcare abroad is 3 to 5 times more expensive as compared to Pakistan. When a medical emergency occurs in a foreign country, where you are not aware of what hospitals to look for; travel insurance supports you financially and as a best friend through 24/7 assistance service by facilitating you with the best hospital. Best Travel insurance policies not only cover for out-patient expenses but in case of a life-threatening situation extends coverage to pre-existing ailments.

24/7 Travel AssistanceUnfortunate events occur throughout life, but if these happen while you are outside your home country, you need a local support. Since Travel insurance is designed to support you during your trips, this also provides you support service wherever you are across the global. The travel assistance service providers assigned by your insurance company makes sure that immediate assistance is available for an evacuation, admission to the nearest hospital or guidance on process for reissuance of misplaced travel documents. You enjoy a hassle-free process as customer care would work with the local medical provider or authorities directly and ensure that you are relieved of this stress.

Budget LockTravel insurance helps you maintain your trip expensive within the budgets. Since you exchange unforeseen expenses with an insurer against premium, you know exactly what expense you would make for the trip, hence you maintain within budget.

Protect Pleasant MemoriesTravel insurance is designed to keep you contented until you return home with pleasant memories of your trip. Any unfortunate event that would incur financial loss or produce any sort of hassle are absorbed by the insurer and the global assistance service provider.

This plan is designed to meet requirement of travel insurance when applying for a Visa of Schengen countries. This plan covers a minimum of EUR 30,000 medical expense as required by Schengen countries.

Hajj & UmrahRelief yourself from risk of uncertain events by getting your Hajj, Umrah or Ziarat to Holy sites insured. This product is specially designed for the pilgrims to perform their Hajj & Umrah with a peace of mind and travel back to their loved ones safely.

Student PlanTraveling for higher education, trainings or on student exchange program, Student plan is designed for students to cover health expenses, emergency return to home, and other benefits during their stay abroad for study.

Domestic TravelExploring Pakistan with family, travelling domestically on business trip or for a family commitment, this is the most economical plan that covers you from any medical emergencies, flight delays, loss of baggage or CNIC and a lot more.

WorldwideTravel anywhere across the globe with high limits of coverage and benefits. This plan is most suitable to travelers with high volume of annual trips. The coverage limit for most insurers for this plan starts at USD 50,000.

Rest of the WorldLooking for minimum coverage at low cost? Don’t worry, rest of the world plan gives you all features of best travel coverage with low limits at low premium. This is best for those who do not require travel insurance to meet visa requirements.

Comet is pioneer in offering Travel Insurance portal to Travel Agent with range of multiple plans of various insurance companies all in one place. Comet’s Insurance Manager provides its corporate customers with the following facility on the portal;

Insurance Manager Facilities